- Lending

- Home Loans

- Refinance

- First Home Buyers

- Parental Guarantee

- Investment Loans

- Fixed, Variable & Split Rate Loans

- Reverse Mortgages

- Pre Approved Loans

- Rentvesting

- Business

- Commercial Finance

- Equipment Finance

- Blog

- Calculators

- Contact Us

- About Us

- Team

- Community Involvement

- Brand Ambassador – Jake Birtwhistle

How a SMSF Can Set You Up For Retirement

What is a SMSF?

Self-managed super funds (SMSF) are a different way of saving for retirement. They differ from a normal superannuation fund as the members of the fund are normally also the SMSF trustees and make the important decisions on how funds are invested.

A SMSF gives you flexibility and control over where your retirement funds are invested based on your risk tolerance, and investment options can include residential and commercial property. It is important to remember that the ‘sole purpose’ of a SMSF is to provide long term retirement benefits and act in the best interest of the members of the fund or their dependants if the member dies before retirement.

SMSF Investment in Australia

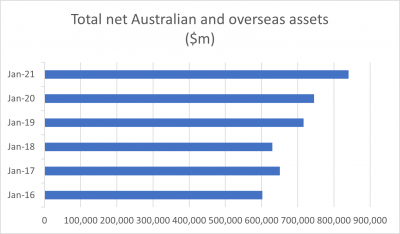

Self-managed super funds are big business in Australia. Statistics released by the Australian Taxation Office in December 2021, showed net investment in Australian and overseas assets of over $840 billion – an increase of almost 10% from December 2020. Tasmanians currently have an estimated $10 billion or a 1.3% share of overall SMSF assets.

According to the ATO statistics, there were 601,906 self-managed super funds with over 1.1 million members. In Tasmania, we have an estimated 7,800 SMSF, or 1.3% of the total number in Australia.

SMSF what can you invest in?

While investment strategy generally follows the more traditional superannuation approach of investing in asset classes such as cash, term deposits and shares (48% of overall investment in December 2021) investors also have approximately $140 billion invested in Australian commercial and residential property. Cryptocurrency also made the asset list for the first time in 2019 and while investment is still relatively low ($227 million) in December 2021, it makes up 2.7% of investment for SMSF valued up to $100k.

However, before you go looking to invest your retirement savings into a new holiday home or the latest NFT trend, you should be aware that setting up an SMSF is a major financial decision that will take time, money, and ongoing commitment and the ATO has very strict rules around what you can invest your money in.

When considering an investment, the ATO expects that it will be made on a commercial ‘arm’s length’ basis and that it will be in the best interests of all fund members. So, for example, your SMSF could purchase a residential property but you, other members of the fund or their family would not be able to live in the property – sorry, there goes the holiday home!

Is a SMSF right for me?

As finance brokers, we can’t give you financial advice or help you decide if a SMSF is right for your financial situation; you will need to seek professional advice from a SMSF specialist to decide if this type of investment is right for your retirement. The ATO also has loads of useful information available here https://www.ato.gov.au/Super/Self-managed-super-funds/

Can SMSF borrow money to buy real estate?

So, you have done your homework, talked to your financial adviser and accountant, and your SMSF account is set up ready to go. With the help of your professional advisors, you can start building your investment portfolio in residential and commercial property and even borrow the funds for the purchase through your SMSF providing you meet the strict guidelines set out by the ATO.

When purchasing residential property, it is important to remember the following rules:

- The property must meet the ‘sole purpose test’. Meaning the property must be purchased for the sole purpose of providing retirement benefits to the members of the fund.

- The property must not be purchased from a related party of a member

- The property can't be lived in by a member of the SMSF or anyone related to a member

Commercial property can also be purchased and can also be leased to a fund member to operate their business however, it must be leased at market rates and follow specific ATO rules.

Who does SMSF lending?

Borrowing to acquire an asset with your SMSF must be done under a ‘limited recourse’ borrowing arrangement. This basically means that should the SMSF default on the loan, the lender’s rights are limited to that particular asset, and any other assets held by the SMSF are protected. Of course, there is more to it than that, but that gives you the idea! Not all lenders offer this type of ‘limited recourse’ lending, and you must get it right.

This is where we can help! Here at Finance Brokers Tasmania, we have years of experience helping SMSF purchase assets and have access to a number of different lenders who can offer loan to value ratio (LVR) up to 80% of the valuation of a commercial property and 90% for residential.

So, let’s get talking!