Time flies when you’re having fun – and we’ve had a great time over the past 35 years serving the Tasmanian community. But did you know that when we opened, we were the first brokers in the state? Read on for our origin story…

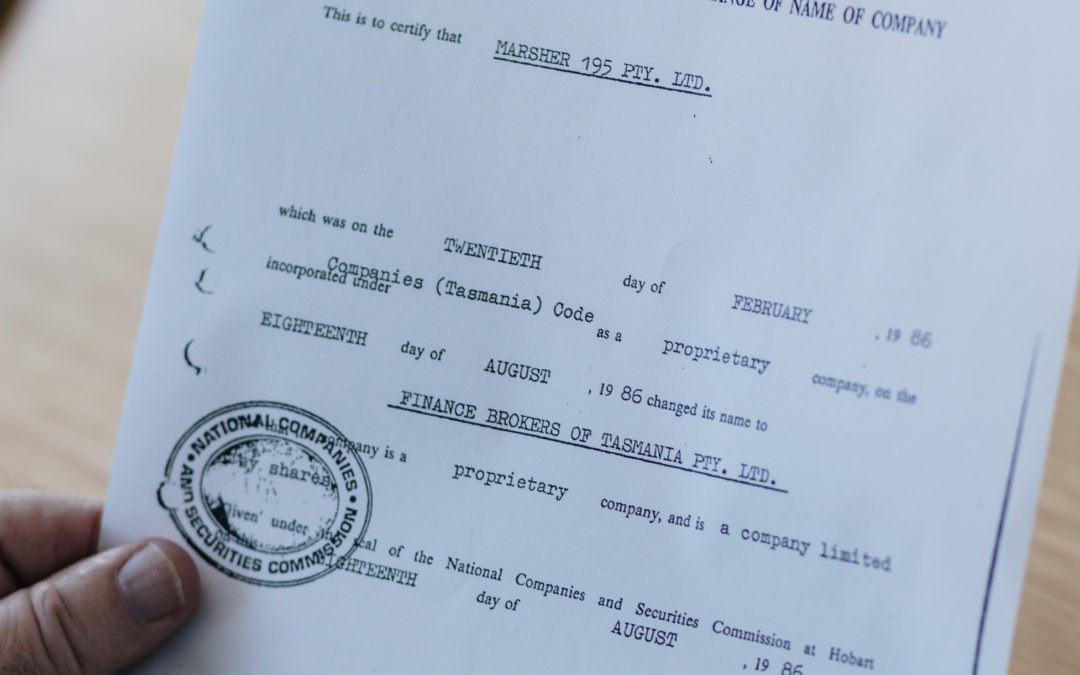

Dynamic Finance Brokers Tasmania first opened its doors on Monday 18th August 1986. Originally named Finance Brokers of Tasmania, the idea for the business came from Lance Cure after 6 years as a banker in Tasmania. At the time, there were 12 finance companies and 8 banks in Tasmania – but no brokers.

In his travels, Lance saw an opportunity to help people and businesses that worked outside the regular 9 to 5 office hours. His first clients were people in the transport and logging industries who needed help obtaining loans for vehicles and equipment. The early days of the business were spent travelling to country hotels where the loggers and drivers were staying, and holding meetings over a pub meal with his clients.

From those early days, we’ve grown to become Tasmania’s most trusted brokerage. We now employ 12 staff across two offices in Launceston and Hobart – and continue to meet our clients outside of hours (though, sadly, not over pub meals).

We know we do our best to provide service excellence, and we have the award to prove it! In May 2021, Director and Senior Broker Lance was awarded the National Yellow Brick Home Loans Award for Most Valued Broker – an award judged on a wide range of criteria including loan volumes, quality of applications, contributions to the Yellow Brick Road organisation, and assisting other members.

We’ve been represented by some famous faces as our brand ambassadors. You may remember our brand ambassador from a few years ago: Australia’s favourite veterinarian, Dr. Harry Cooper. Nowadays, we’re proud to partner with Olympic triathlete Jake Birtwhistle – a true gent that embodies the values of excellence, consistency, and experience that we’ve become renowned for.

For 35 years, it’s been our pleasure to assist Tasmanians to achieve their dreams and find their best future – whether it’s first-home owners navigating their first purchase, investors looking to refinance, or Tasmanian businesses seeking funds to purchase equipment. Happy 35th birthday to us! Here’s to many more.